Session from the November 19-20, 2024 OpenFinity Expo

Video replay and slides available here:

Session Description:

Building and growing a banking API platform takes more than delivering compliant open banking APIs. It requires understanding the needs of your ecosystem, establishing lightweight processes that drive discoverability, providing the resources for self-service enablement, and delivering a federated API coach program to scale your efforts.

This presentation explores the practices and patterns implemented by global organizations that will help your open banking initiatives shift from interoperability to a transformational open banking API platform.

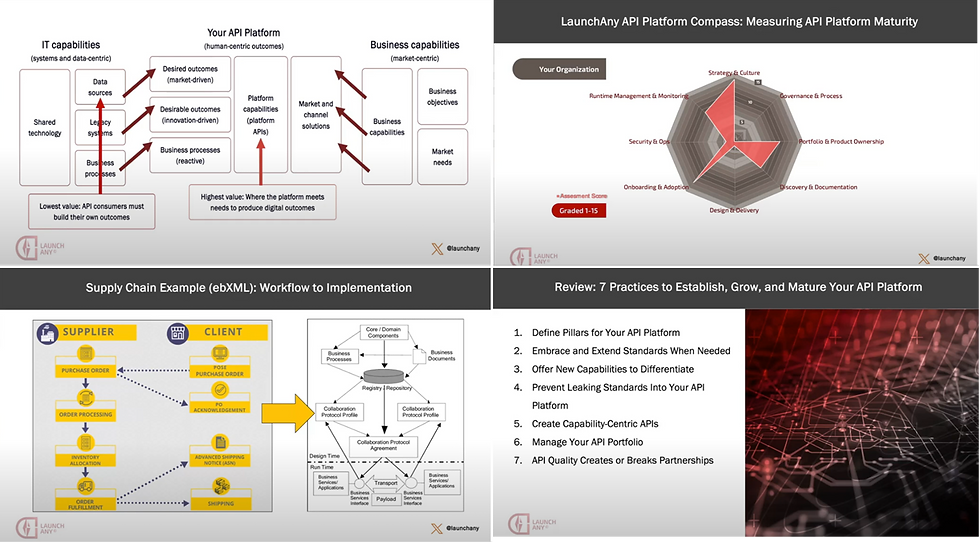

Samples from the presentation

Key Takeaways:

APIs as an Ecosystem, Not Just Tools: APIs should be viewed as an intentionally designed ecosystem that empowers customers, partners, and internal teams to deliver desired outcomes. Organizations must align their business and IT capabilities to build platforms that meet market demands and foster innovation.

Move Beyond Compliance to Drive Differentiation: Compliance with standards like CFPB 1033 ensures interoperability and data portability, but organizations must go beyond compliance to deliver exceptional customer experiences. Innovation and differentiation come from extending standards and adding unique capabilities.

Establish Clear API Platform Pillars: Building a successful API platform requires strategy, governance, product ownership, documentation, secure design, onboarding processes, and robust runtime management. These pillars ensure scalability, discoverability, and continuous improvement.

Adopt a Digital Product Mindset: Treat APIs as digital products, assigning ownership to teams to ensure alignment with business goals and to deliver value. Documenting and making APIs discoverable is critical for reusability across the organization and among partners.

Balance Compliance with Internal Optimization: Standards can introduce constraints, but organizations should optimize their internal operating model first and then adapt to standards. This approach avoids performance issues and enhances flexibility in delivering new capabilities.

Implications

Transformational Opportunity: Compliance with open banking regulations like CFPB 1033 is just the starting point. Organizations that invest in building robust, secure, and innovative API platforms will lead in delivering superior customer experiences and achieving market differentiation.

Innovation Drives Growth: Financial institutions must extend beyond standardized APIs to deliver unique capabilities. By doing so, they can monetize their API platforms, attract more partners, and stand out in a competitive market.

Strategic API Culture: To truly benefit from APIs, organizations need a cultural shift where APIs are seen as core to the business strategy, not just IT tools.

By focusing on these practices, banks and credit unions can build API platforms that drive innovation, improve operational efficiency, and unlock new revenue streams in the age of Open Finance.